In the world of stocks and investments, niche industries and emerging markets often offer significant opportunities for growth, but they also come with a fair amount of risk. One such emerging area is the development and commercialization of MDMA, commonly known for its recreational use as Ecstasy, but also showing significant potential in the realm of mental health treatment.

MDMA stock represents a portion of ownership in companies developing MDMA-based therapies, especially for conditions like PTSD (Post-Traumatic Stress Disorder), depression, and anxiety. The regulatory environment and the slow but steady acceptance of psychedelic substances as legitimate treatments have made MDMA stock an intriguing option for investors seeking growth in the mental health and biotechnology sectors.

This article will provide an in-depth exploration of MDMA stock, including the companies driving its development, the therapeutic potential of MDMA, how to analyze MDMA stock from an investor’s perspective, and the risks and rewards associated with this unique investment category.

1. Understanding MDMA Stock: What Is It and How Does It Work?

The Basics of MDMA in Therapeutic Settings

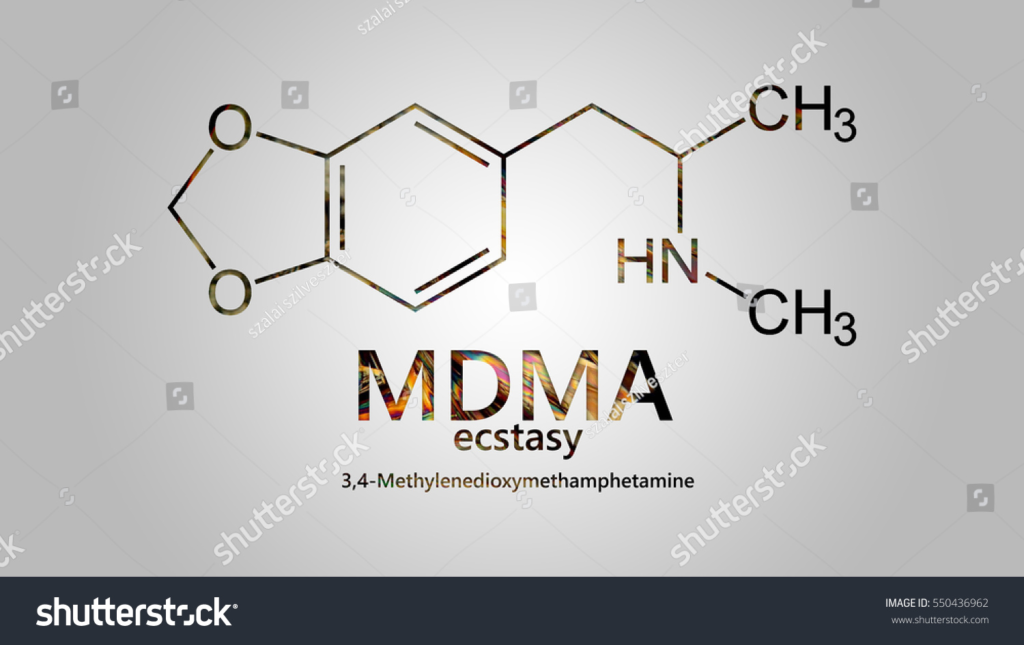

MDMA (3,4-methylenedioxymethamphetamine) is a synthetic drug most commonly associated with recreational use in social settings, often referred to as Ecstasy. However, over the past few decades, MDMA has garnered attention for its potential therapeutic uses. Studies have shown that MDMA can help individuals with PTSD by enhancing emotional connection and reducing fear responses, providing a deeper understanding of its potential in psychotherapy.

MDMA stock, therefore, refers to shares of companies or biopharmaceutical firms developing MDMA-based treatments. The stock may represent both the potential to revolutionize mental health care and the opportunity to profit from a growing market, should these treatments receive regulatory approval.

- Key Players in MDMA Stock: Companies like MAPS (Multidisciplinary Association for Psychedelic Studies) and Compass Pathways have become the leading players in the field, conducting clinical trials and lobbying for the legalization and medical use of MDMA. Investors looking to dive into MDMA stock typically examine the companies that are researching and advancing MDMA as a prescription medication.

2. Why Invest in MDMA Stock? The Potential for Mental Health Innovation

Examining the Investment Opportunity and Its Growth Prospects

The global mental health crisis, exacerbated by factors such as the COVID-19 pandemic, has led to increased interest in alternative therapies for conditions like PTSD, anxiety, and depression. Traditional medications and therapies have not always been effective, leading many to look for innovative solutions. MDMA-based therapies, especially when used in conjunction with psychotherapy, have shown promising results in clinical trials.

MDMA stock represents an opportunity for investors to back a potential breakthrough in mental health treatment. The excitement around MDMA is not just due to its therapeutic effects but also its ability to address conditions that affect millions worldwide.

- Mental Health Demand: According to the World Health Organization (WHO), depression is the leading cause of disability worldwide, and PTSD affects millions of people globally. With existing treatments falling short for many patients, MDMA stock has become an investment in innovation, with the promise of meeting an urgent need.

- Scientific Backing and Trials: As more clinical trials unfold, the scientific validation of MDMA as a viable treatment for mental health issues continues to build momentum. Companies leading these trials and testing MDMA’s therapeutic potential are often at the forefront of MDMA stock discussions.

3. Key Companies Driving MDMA Stock Growth

Analyzing the Leading Biotech Firms and Their Stock Performance

Investing in MDMA stock often means looking at the companies behind the research and development. These companies, typically biotech and pharmaceutical firms, are pioneering the use of MDMA as a potential treatment for mental health conditions. Below are some of the most prominent companies in the MDMA stock market:

- MAPS (Multidisciplinary Association for Psychedelic Studies): MAPS has been a leader in the clinical development of MDMA for the treatment of PTSD. They have conducted extensive clinical trials and worked toward receiving FDA approval for MDMA-assisted psychotherapy. The results from MAPS’ trials have been very promising, generating investor interest in their stock offerings.

- Compass Pathways: This UK-based biotech company is also advancing the research of psychedelic therapies, including MDMA. Compass Pathways went public in 2020, and its stock performance has reflected the growing interest in psychedelic treatments. Their ongoing clinical trials for depression and other conditions are a major factor in the stock’s potential.

- Atai Life Sciences: Atai Life Sciences is another key player in the psychedelic industry, investing in companies researching MDMA and other psychedelics. Their investments could drive growth for MDMA-related stocks, as their portfolio includes companies focusing on mental health innovations.

Each of these companies plays a significant role in the future of MDMA stock, and their clinical trial results, partnerships, and regulatory advancements will directly affect their stock price and overall market outlook.

4. The Market Potential for MDMA Stock: How Big Is the Opportunity?

Examining the Broader Psychedelic Industry and MDMA’s Place Within It

MDMA stock isn’t just a speculative bet; it’s part of a broader market that includes psychedelic-based therapeutics. With growing investment in mental health treatments and the rising acceptance of psychedelics for medical purposes, MDMA stock offers significant growth opportunities.

- Psychedelic Therapies Market Growth: The psychedelic medicine market, estimated to grow significantly in the coming years, includes a range of substances like psilocybin, DMT, and MDMA. According to some reports, the market could reach billions of dollars as the demand for effective treatments for depression, PTSD, and anxiety increases.

- Psychedelics and the Regulatory Environment: As MDMA and other psychedelics move closer to receiving FDA approval, their market value increases. The legalization of medical cannabis has shown that regulatory approval for controlled substances can dramatically increase both the stock value of companies involved and the public perception of the market.

- The Role of Investors: Institutional investors and venture capital firms have increasingly turned their attention to psychedelic stocks, including MDMA-based therapies. These investments further drive growth and fuel the optimism surrounding MDMA stock.

5. Risks of Investing in MDMA Stock

Understanding the Potential Downside and Market Risks

While the future of MDMA stock is promising, it’s essential to consider the risks involved in investing in this niche sector. As with any emerging market, MDMA stocks come with high volatility, regulatory hurdles, and market skepticism. Below are some of the risks investors must weigh:

- Regulatory Uncertainty: The approval process for new drugs, especially psychedelics, is lengthy and unpredictable. Regulatory bodies like the FDA have shown interest in MDMA-based therapies, but approval is not guaranteed. Any setbacks in the clinical trial process could negatively impact stock prices.

- Market Volatility: Biotech stocks, including MDMA-related companies, are notoriously volatile. External factors such as shifts in investor sentiment, government policy, or negative clinical trial results can lead to significant stock price fluctuations.

- Ethical and Social Considerations: Psychedelics are still a controversial topic in many circles, which could lead to societal or political pushback that may impact the market for MDMA treatments.

6. How to Evaluate MDMA Stock as an Investor

Steps for Making Informed Decisions on MDMA-Based Investments

Before diving into MDMA stock, investors should conduct thorough research and consider various metrics to assess the stock’s potential:

- Clinical Trial Progress: The success or failure of clinical trials is one of the most important indicators of the future viability of MDMA stock. Keeping an eye on trial results, regulatory filings, and partnerships with major pharmaceutical companies can provide insight into the stock’s direction.

- Management and Strategy: The strength of a company’s leadership and its strategic direction will be key to its success. Investors should review the management team’s track record in drug development and its approach to overcoming obstacles in the psychedelics space.

- Market Sentiment and Trends: Follow news about psychedelic legislation, clinical results, and the public’s reception to MDMA therapies. As public perception shifts toward acceptance of psychedelics for medical use, the market for MDMA stock will likely grow.

7. Conclusion: Is MDMA Stock a Worthwhile Investment?

Summing Up the Key Insights and the Future of MDMA Stock

MDMA stock represents a unique opportunity in the emerging psychedelic medicine market. With strong clinical backing, growing investment, and increasing acceptance of psychedelics for mental health treatments, the future of MDMA stock looks promising. However, potential investors should proceed with caution, considering the inherent risks of the biotechnology and pharmaceutical industries.

For those willing to invest in an innovative and high-risk, high-reward sector, MDMA stock could be a lucrative opportunity. However, as with all investments, it’s essential to conduct proper due diligence, stay informed, and carefully assess your risk tolerance.